Recently, MicroStrategy, known for its investments in Bitcoin, is nearing the qualification criteria for the S&P 500 index. This event could have far-reaching effects not only for the company itself but also for the Bitcoin market. The S&P 500 index, which tracks the 500 largest companies listed on US stock exchanges, is a barometer of the health of the US economy, and the potential inclusion of a company as heavily involved in cryptocurrencies as MicroStrategy could be a significant signal for investors.

In recent months, the value of MicroStrategy’s shares, listed on NASDAQ under the symbol MSTR, has significantly increased, reaching a market capitalization of about $12.4 billion. This brings the company closer to the magical threshold of $15.8 billion, required for inclusion in the prestigious S&P 500 index. This increase, synchronous with the rising Bitcoin prices, which itself gained 22.5% in value over the last month, puts MicroStrategy in a promising position.

Known for accumulating Bitcoin, MicroStrategy has in the past used stock sales to fund purchases of this cryptocurrency, which could become even more common if its share value continues to rise. With over 190,000 BTC held by the company, their value has already exceeded $10 billion, indicating significant involvement in the cryptocurrency market.

Entry into the S&P 500 index could bring MicroStrategy not only increased prestige but also a new influx of investors, including passive ones who may not necessarily be looking for direct exposure to Bitcoin. Analysts predict this could create a positive feedback loop, introducing Bitcoin to a wide range of investment portfolios, even unintentionally.

However, despite many optimistic forecasts, inclusion in the S&P 500 is not yet certain. The company must meet a series of criteria, including being based in the USA, demonstrating sufficient liquidity, and positive financial results over the last four quarters. Moreover, as experts note, using shares of companies like MicroStrategy as indirect exposure to Bitcoin can be misleading, as they are subject to a wider range of variables than the cryptocurrency itself.

Nonetheless, the potential inclusion of MicroStrategy in the S&P 500 index is an event that could significantly impact the cryptocurrency market, signaling greater acceptance of Bitcoin by the mainstream financial industry. At the same time, it’s important to remember the complexity of such moves in the market and the possible effects, which may not always be fully predictable.

The prospect of including MicroStrategy in the S&P 500 index sheds new light on the position of Bitcoin and other cryptocurrencies in the global financial system. This could be a turning point that contributes to the further legitimization of digital currencies as a key component of investment portfolios. However, the potential effects of this move require careful analysis and understanding of both the opportunities and risks associated with such a dynamically changing market.

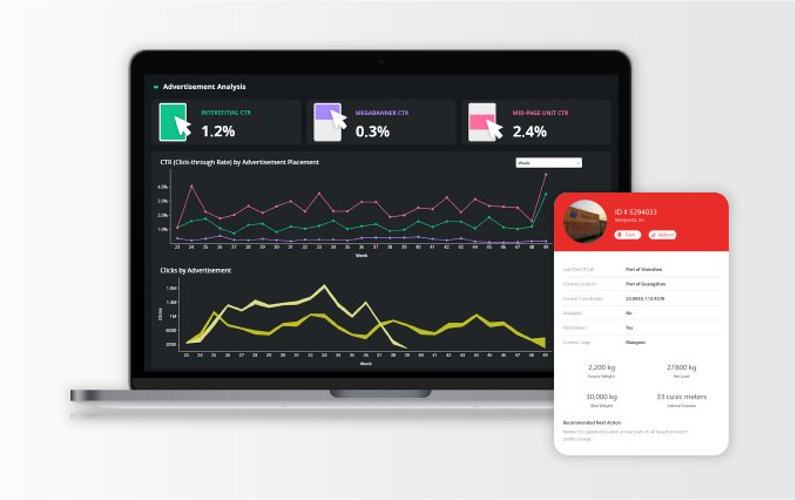

Photo: MicroStrategy