Recent events in the cryptocurrency market have brought significant price changes to well-known tokens. Shiba Inu, known as a “meme coin”, has made an impressive price breakthrough, surpassing a significant value threshold. Cardano has also made its presence felt in the market, overcoming previous price trends. Meanwhile, Ethereum, after a series of increases, now seems to be undergoing a correction phase. Is this the beginning of a new chapter in the cryptocurrency market?

Shiba Inu: Not Just a Jump, but a Steady Increase

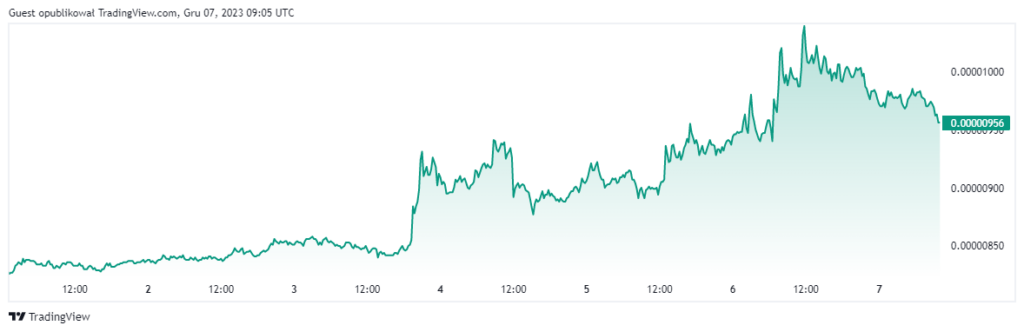

Shiba Inu (SHIB), often treated as just a “meme coin”, surprised investors by exceeding a price of about $0.00001. This is not just a temporary jump, but a significant breakthrough that could strengthen SHIB’s position in the market. Chart analysis shows that the token not only approached but exceeded the resistance level, which was a challenge for investors throughout the year.

The rise in SHIB’s price is supported by an ascending trend line, signaling continuous buying pressure. Supporting this dynamic are also moving averages, forming a bullish configuration. However, key for SHIB will now be maintaining support above this new peak to avoid repeating patterns where gains quickly vanished. Current market sentiments differ from earlier, short-term increases of SHIB. A broader bullish phase in the cryptocurrency market in 2023 may provide a more stable foundation for Shiba Inu’s growth.

Cardano: A New Chapter of Growth

Cardano (ADA) recorded a significant price jump, deviating from previous trends. The analysis of ADA’s price chart shows a strong increase, a change compared to historical patterns when ADA typically rose following overall market increases.

Now, ADA aligns its growth with the broader bullish trend in the cryptocurrency market, instead of being a pioneer or lagging behind. The evolving DeFi ecosystem on the Cardano blockchain may be influencing this alignment. ADA’s value increasingly reflects its functional potential, not just speculative movements. Technical indicators for ADA indicate bullish sentiments, and ADA’s price trajectory exceeds both short- and long-term moving averages, usually heralding positive price activity.

Ethereum: A Short Break or a Prelude to Correction?

Recently, the price of Ethereum (ETH) experienced a retreat, prompting the crypto community to ponder whether this is the start of a correction phase or just a brief pause before further increases. ETH’s price has pulled back from recent highs but remains well above key moving averages, suggesting that the upward trend is still valid.

The market is closely watching support levels that could provide a springboard for further price increases if they prove solid. Ethereum’s current position relative to Bitcoin cannot be ignored. During Bitcoin’s correction periods, there is often a flow of funds into altcoins like Ethereum, which can lead to price increases and activity on its network. RSI levels indicate that Ethereum is not yet in the overbought zone, leaving room for potential increases.

The cryptocurrency market has recently brought many surprising changes. Shiba Inu and Cardano have recorded significant increases, while Ethereum is at a crucial moment that will decide its future direction. Observing these trends is not only fascinating but also crucial for understanding the dynamic world of cryptocurrencies.