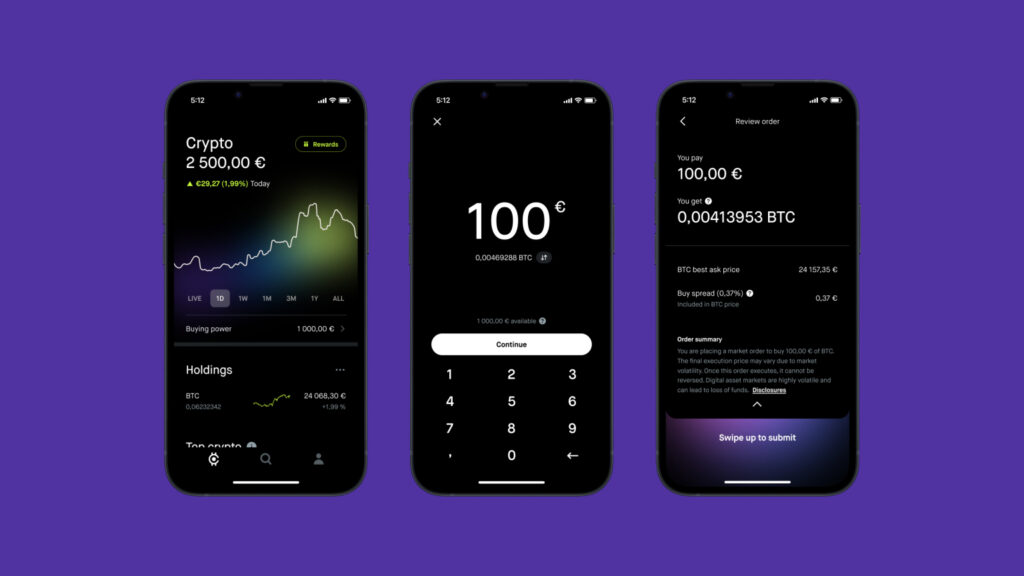

Robinhood, a well-known trading and brokerage platform, is expanding its wings in Europe, introducing cryptocurrency trading services. This strategic move allows access to over 25 different cryptocurrencies, opening doors to the dynamic world of digital assets for customers in the European Union.

Robinhood, a platform that gained popularity by simplifying stock trading, is now challenging the cryptocurrency market in Europe. Entering the European market is part of the company’s broader international expansion strategy. Offering a wide range of over 25 cryptocurrencies, Robinhood is becoming an important player in the digital currency world.

The expansion of Robinhood’s services in Europe follows shortly after the introduction of its stock trading app in the United Kingdom. Oliver McIntosh, Senior Manager of Product Communications at Robinhood, emphasizes that the EU market is in line with the company’s international expansion plans. The EU, with its modern cryptocurrency market regulations such as the Markets in Crypto-Assets Regulation (MiCA), creates favorable conditions for the growth of this sector.

McIntosh highlights Robinhood’s mission of democratizing finance, and notes that introducing a custodial cryptocurrency product for EU customers is a significant step in this direction. Despite inquiries about further expansion plans in the EU, Robinhood is currently focusing on implementing its cryptocurrency trading app for European Union customers.

A key element of Robinhood’s offering is its no-transaction-fee trading model. The platform goes a step further, offering customers additional benefits – a monthly percentage return on the volume of their transactions in the form of Bitcoins. Moreover, the platform emphasizes transparency, enabling users to easily track the spread and discounts obtained by the company from buying and selling transactions.

McIntosh points out Robinhood’s partnership with various cryptocurrency trading venues, allowing the platform to offer competitive prices. The company benefits from variable volume-based discounts offered by these trading venues, ensuring users access to competitive prices during cryptocurrency transactions.

Robinhood initially revealed its intention to enter the European market in November. The latest expansion into Europe comes after the cessation of cryptocurrency trading services in the United States six months ago, a decision dictated by increasing regulatory pressures and legal proceedings faced by other cryptocurrency firms at that time.