Recently, the cryptocurrency markets have experienced significant fluctuations, with particular attention drawn to the situation of Bitcoin. Although many investors and analysts still believe in its long-term potential, recent market events have led to a decline in the value of this most popular cryptocurrency. Let’s analyze the key factors that have influenced today’s drop in Bitcoin’s price and consider what the future may hold.

Liquidation of Long Positions in the Bitcoin Market

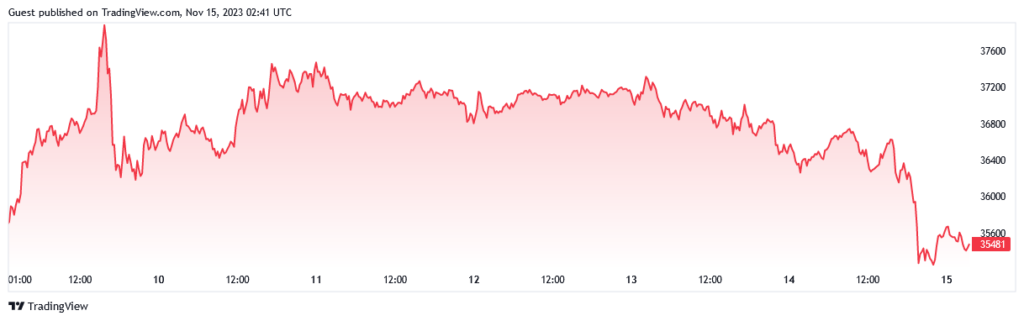

On November 14, we observed a significant drop in the value of Bitcoin. Although inflation in the United States was lower than expected (annual increase of 3.2%), it did not protect Bitcoin from losing its upward momentum. Today’s price drop was the result of a mass liquidation of long positions (so-called ‘longs’) in the futures market. Within one hour, positions worth nearly $98 million were liquidated, with the total value of liquidations over 24 hours exceeding $126 million. Such a phenomenon often leads to a price drop, as there is insufficient buying pressure to maintain value.

Analysis of the Current Price Trend

Despite some analysts still being optimistic about the future of Bitcoin, even suggesting the possibility of reaching $48,000, the current situation indicates a weakening of the upward trend. A decline in trading volume of over $7 billion since the beginning of November raises questions about the durability of the current bull market.

Status of Bitcoin Wallets and Profit Realization

An interesting aspect is that despite the price drop, a record number of Bitcoin wallets remain profitable. Although this may seem like a positive signal, there is a risk that an increase in the number of investors making a profit could lead to further profit-taking and a potential price drop.

Bitcoin ETF and Institutional Interest

Despite short-term uncertainty, financial institutions seem to be interested in Bitcoin in the long term. Examples include two major institutions, BlackRock and Invesco Galaxy, which have applied to create Bitcoin ETFs. However, due to regulations, decisions on this matter may be delayed until 2024.

Macroeconomic Impact and the Future of Bitcoin

Bitcoin is sensitive to macroeconomic events, such as changes in interest rates or news regarding regulations. Although predictions vary, from expectations of reaching $69,000 in the short term to fears of further decline, most of the market still believes in a rebound and increase in Bitcoin’s value in the long term.

Summary

The cryptocurrency market, particularly Bitcoin, remains dynamic and full of surprises. Today’s decline in value is a reminder of the volatility and investment risk. However, there are still many signs that can give both short-term and long-term investors in this digital currency cause for optimism.