Uniswap, the leading decentralized cryptocurrency exchange, responds to the decline in its users’ activity. The newly announced beta version of the mobile wallet for Android might be the key to reversing this trend.

In the world of cryptocurrencies, changing trends and user behaviors can significantly affect the fate of projects. Uniswap, one of the leading players in the decentralized exchange market, is no exception to this rule. In response to a decrease in user activity, the company decided to invest in mobile technology.

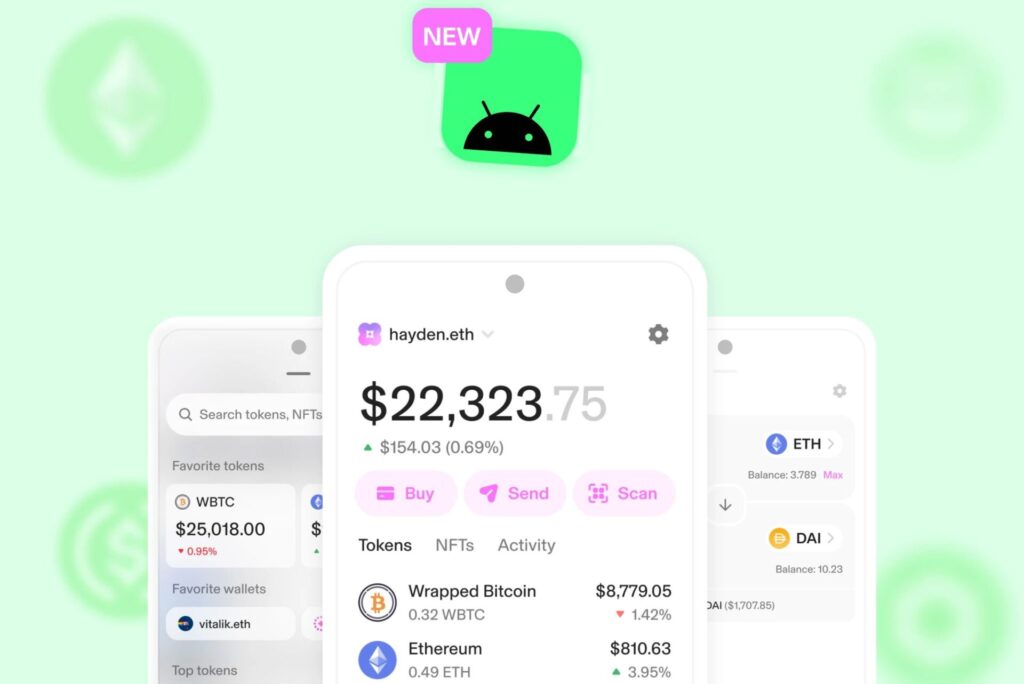

On October 12th, Uniswap officially announced the introduction of a mobile wallet for the Android system in beta. This move follows the April debut of the Uniswap wallet for the iOS system. Until then, most transactions were conducted through a web application.

The new wallet will allow users to exchange tokens on multiple chains, such as Ethereum, Polygon, Optimism, Arbitrum, Base, or BNBChain, without needing to switch networks. Moreover, the application itself will recognize which network a given token is on and will automatically switch to the appropriate network.

In the world of Uniswap, not everything is rosy. Data from Token Terminal indicates that since May, the company experienced a steady decline in activity. The monthly number of active users decreased by as much as 23%. This month, Uniswap recorded 719,669 active addresses.

Due to the decrease in the number of users, the number of transactions began to decrease from June. Data from CryptoQuant shows that between June 28 and September 18, the average daily number of transactions on Uniswap decreased by 54%. Nevertheless, in the last month, the exchange experienced a certain revival, with the number of transactions increasing by over 50%.

Along with the decreasing number of users, Uniswap’s network fees began to decrease (between May and September, monthly by as much as 68%). To give some context, in May they amounted to 74 million dollars, and in September to less than 25 million dollars.

The current price behavior of the UNI token, which has dropped by 10% since the beginning of the month, might also be concerning. This is the result of diminishing interest in the DeFi token among investors.

Market indicators for UNI point to the current downward trend. The Relative Strength Index (RSI) was 33.61, while the Money Flow Index (MFI) was 34.77. An analysis of the indicators indicates a dominance of sellers over buyers, which may suggest a lack of confidence among investors in Uniswap’s future.