In the cryptocurrency market, where price volatility is the order of the day, stablecoin Tether (USDT) seems to be a bastion of stability. However, recently there have been questions about its safety. So, is Tether the safest option for storing crypto? Meanwhile, the hybrid platform Tradecurve is causing a wave of excitement among investors, attracting over 3 million dollars during the pre-sale.

Stablecoin Tether (USDT) is the largest of its kind in the cryptocurrency market, with a market capitalization exceeding 83 billion dollars. However, there are several factors to consider when assessing the safety of a stablecoin. One of these is the assets backing the stablecoin, such as gold, government treasury bonds, etc. The issuer of the stablecoin must also have sufficient funds to meet all redemption requests.

Tether, despite the controversies that have accompanied it over the past year, has introduced a number of measures aimed at increasing the transparency of its actions. The platform regularly publishes audits of its dollar reserves. Tether has also taken steps to increase its dollar reserves. According to a report for the first quarter conducted by the financial services firm BDO Italia, Tether had about 2.44 billion dollars of excess reserves.

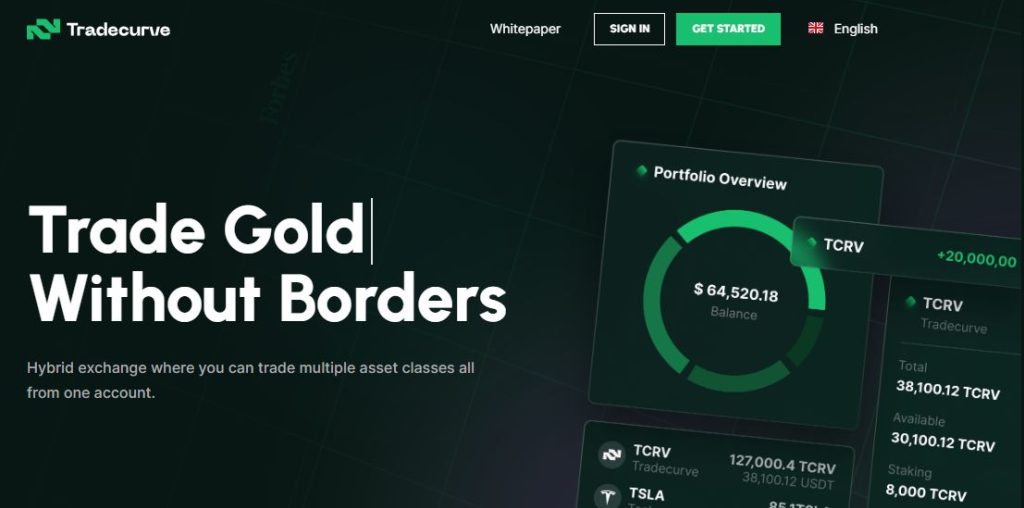

On the other hand, Tradecurve, a hybrid trading platform, is causing a lot of excitement, gathering over 3 million dollars during the pre-sale. It mixes elements of centralized exchanges (CEX) and decentralized (DEX), creating a private trading environment that is key in the era of data security breaches, especially for traders who value privacy.

Unfortunately, many traditional trading exchanges have not yet implemented a PoR (Proof of Reserves) system, leading to a loss of trust from traders. Tradecurve aims to fill this gap, increasing user trust and promoting exchange integrity by implementing PoR.

The Tradecurve token (TCRV) has attracted significant attention from the crypto community. Its price has risen by 150% over the past month, from $0.015 to $0.025. Tradecurve stands out from the competition, such as Huobi or Coinbase, with its emphasis on decentralization, user anonymity, and privacy.

It is predicted that with the current upward trend, the token could reach a value of $0.029 in the 6th pre-sale stage. Experts predict that the launch of the platform will attract a wave of traders to Tradecurve, causing a 50-fold increase in the value of TCRV in 2023, with the price reaching up to $1 per token.