In the cryptocurrency environment, Bitcoin consistently outperforms the competition, especially in the face of growing geopolitical tensions and market uncertainties. Despite prevailing selling pressures, billionaire investors like Paul Tudor Jones see Bitcoin as a potential hedge against global risks.

In times when geopolitical uncertainty seems to touch every corner of the globe, it’s hard to find assets that offer a sense of security. Bitcoin, the original cryptocurrency, appears to be such an asset for many market experts.

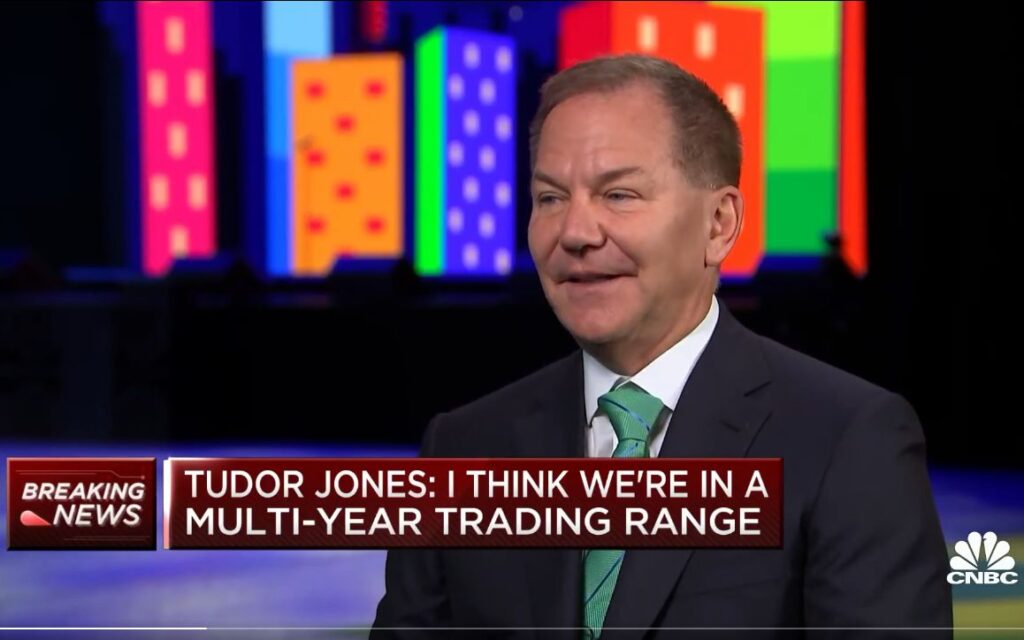

Billionaire and hedge fund manager, Paul Tudor Jones, in a recent interview with CNBC, expressed his concerns about investing in stocks in current times. He pointed out the geopolitical uncertainty and the weak fiscal situation in the United States, where the debt-to-GDP ratio has already exceeded 122%. In such a context, from an investment standpoint, Bitcoin seems more attractive.

Tudor Jones also discussed the macroeconomic issue, pointing to rising interest rates in the United States. Higher rates lead to increased borrowing costs, resulting in increased debt issuance. As a result, the increased issuance of bonds leads to further interest rate rises, creating a detrimental and potentially unbalanced cycle.

“I can’t love stocks,” admitted Jones, but added that both Bitcoin and gold should make up a larger portion of investment portfolios than they currently do. It’s not the first time Jones has expressed a positive opinion about Bitcoin. Some time ago, he said, “Bitcoin is mathematics,” emphasizing that this cryptocurrency offers certainty in a world full of unpredictability.

Despite some adversities in the cryptocurrency market recently, with Bitcoin trading below the $28,000 mark, it still shows strong performance compared to other cryptocurrencies. Its share in the global cryptocurrency market has now surpassed 50%. This year, Bitcoin’s value has increased by 66%, while Ether has seen a 32% rise.

Given the macroeconomic uncertainties, Bitcoin will likely continue to outperform other assets. However, despite all its advantages, it’s important to remember that investing in cryptocurrencies comes with risks and it’s always worth approaching with due caution.