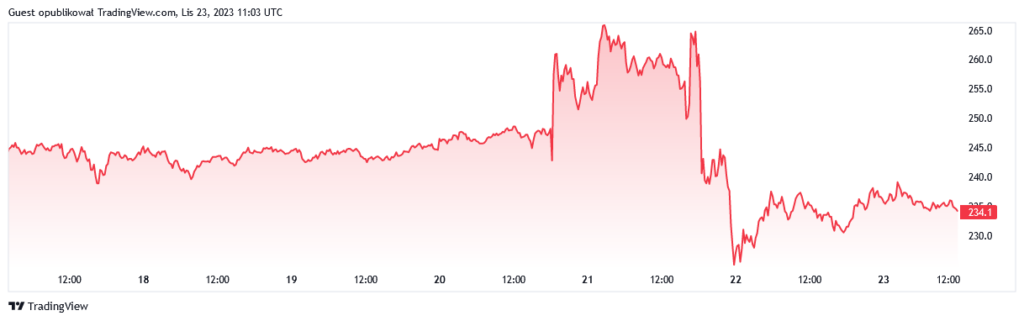

The cryptocurrency market, always dynamic and full of surprises, surprises again. Binance Coin (BNB), one of the leading exchange tokens, experienced a significant price shock, losing value in a short time. Today it maintains a steady level of around 235 dollars, but its future is uncertain.

In the last 48 hours, Binance Coin (BNB) has gone through an extraordinary wave of price volatility. The drop in the token’s value from 271.9 to 224 dollars in just eight hours (a change of 17.62%), which occurred in the evening of November 21 following news about troubles at the Binance exchange and the departure of its head, caused concern in the market. (READ: BNB Price Up and Down – Consequences of Binance’s Settlement with the US Department of Justice). However, despite the prevailing fear, analysts see opportunities for short-term growth.

BNB’s price volatility, though surprising, was not unfounded. News about the market situation and related expectations influenced the price dynamics. The market structure of BNB changed unfavorably after significant losses recorded on November 21, but bulls may regain the initiative.

Fibonacci levels have proven to be an essential tool in analyzing the situation. The RSI (Relative Strength Index) for BNB on the daily chart fell below the neutral level of 50, indicating a predominance of a downward trend. Nevertheless, the 78.6% Fibonacci retracement level was not decisively broken.

A slight drop to 224 dollars, just below the mentioned 78.6% level, followed by a rebound to 238.5 dollars, suggested that the market might have changed direction. Additionally, observing the On-Balance Volume (OBV) showed a sharp drop in selling volume on Tuesday. If this indicator maintains a downward trend, and prices do not exceed the 240 dollar level, expectations for a quick rebound may be revised.

Analysis of liquidation levels based on data from Hyblock indicates a stronger short-term bullish sentiment than bearish. This was due to two reasons. First, the Cumulative Liquidation Level Delta was deeply negative, meaning that bears could suffer significant losses if the BNB price trend reverses.

Second, there were significant pockets of liquidity above the current price level. For example, a move to 250.7 USD could trigger liquidations of short positions worth 15 million dollars.

Combining the Delta with several nodes that could cause large liquidations of short positions above 250 dollars makes a move of BNB to levels of 250 and 272 dollars quite probable.

Despite BNB’s dramatic drop in value, there are technical data indicating the possibility of a trend reversal. The final decision on investments should always be supported by thorough analysis and be prudent, especially in such a volatile environment as the cryptocurrency market.