The London-based company, Jacobi Asset Management, has announced the introduction of its Bitcoin ETF to the Euronext exchange in Amsterdam. It is a historic moment for the crypto market in Europe, while the United States lags behind in this competition.

A new star has emerged in the world of digital finance. The London asset management company, Jacobi Asset Management, has announced the launch of its Bitcoin-based ETF (Exchange-Traded Fund) on the European Euronext exchange in Amsterdam. It is the first such fund on the Old Continent, strengthening Europe’s position in the global technological rivalry, especially against America.

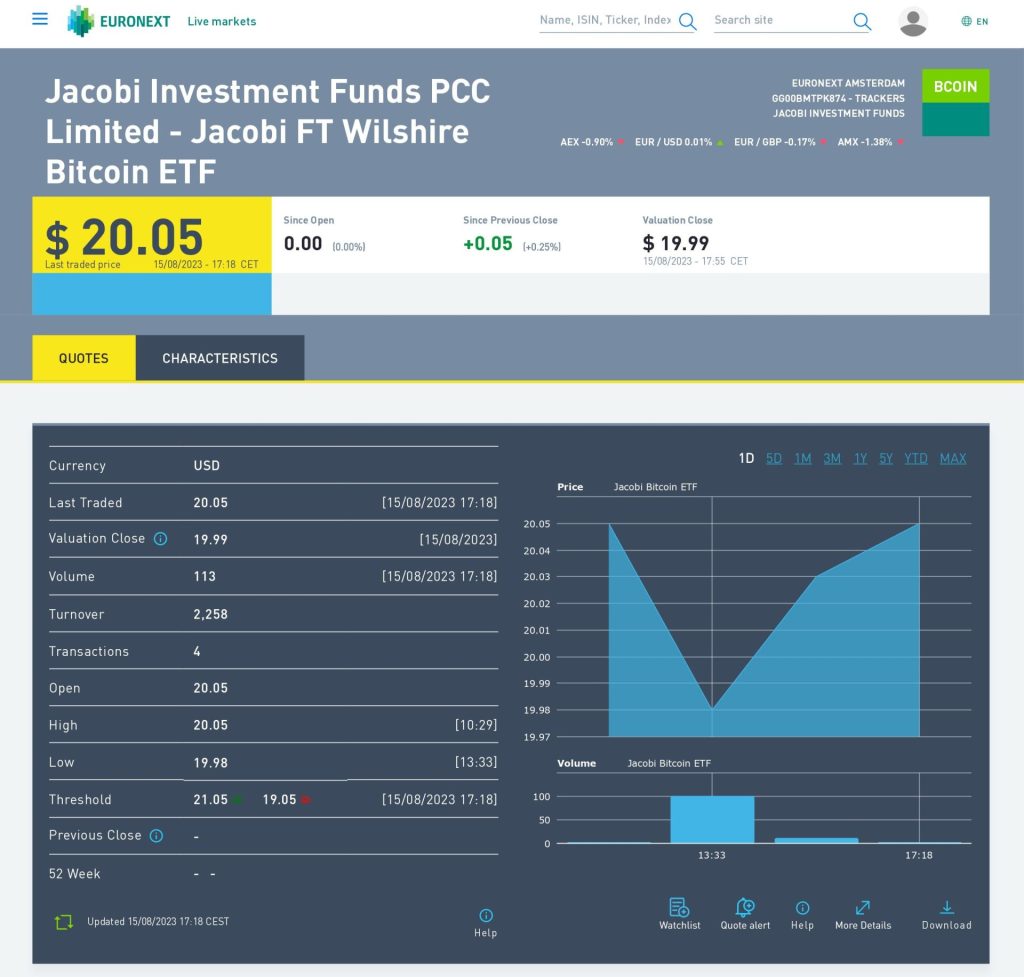

The new Bitcoin ETF is available under the ticker BCOIN. Earlier, in October 2021, the ETF was authorized by the Guernsey Financial Services Commission. Although the company intended to launch the product in 2022, it decided to postpone these plans due to unfavorable conditions in the crypto market. The challenges included: the collapse of the Terra ecosystem and the fall of the cryptocurrency exchange FTX last year.

The ETF tracks the Melanion Bitcoin Exposure Index, which is a bespoke basket of European and American stocks closely related to BTC’s market price. Unlike traditional ETFs, investors get exposure to a fund that focuses on companies with significant Bitcoin assets, cryptocurrency exchanges, and crypto mining operations.

In its press release, Jacobi announced that Fidelity Digital Assets would provide custodial services for the fund. The fund’s trading side is managed by Flow Traders, which charges an annual management fee of 1.5%.

In an era of growing ecological awareness, the Jacobi company also emphasizes the “green” nature of its Bitcoin fund. A renewable energy certificate (REC) has been added to the ETF. The fund uses external data to calculate the energy consumption of the Bitcoin network and then buys and “retires” RECs. These certificates are also registered on a blockchain platform, allowing investors to verify the fund’s ecological promises.

While Europe celebrates this breakthrough moment, the United States seems to be lagging. Regulators in the US have yet to approve many spot Bitcoin ETF applications, while also taking action against major cryptocurrency exchanges.