In recent months, a fascinating phenomenon has been observed in the cryptocurrency market: Bitcoin, the flagship representative of digital currencies, is surprisingly closing in on gold, long considered a synonym for value and security. This phenomenon, expressed in the increasing price correlation of both assets, reveals a new dimension in the financial world, where traditional and modern forms of investment begin to intersect in unexpected ways.

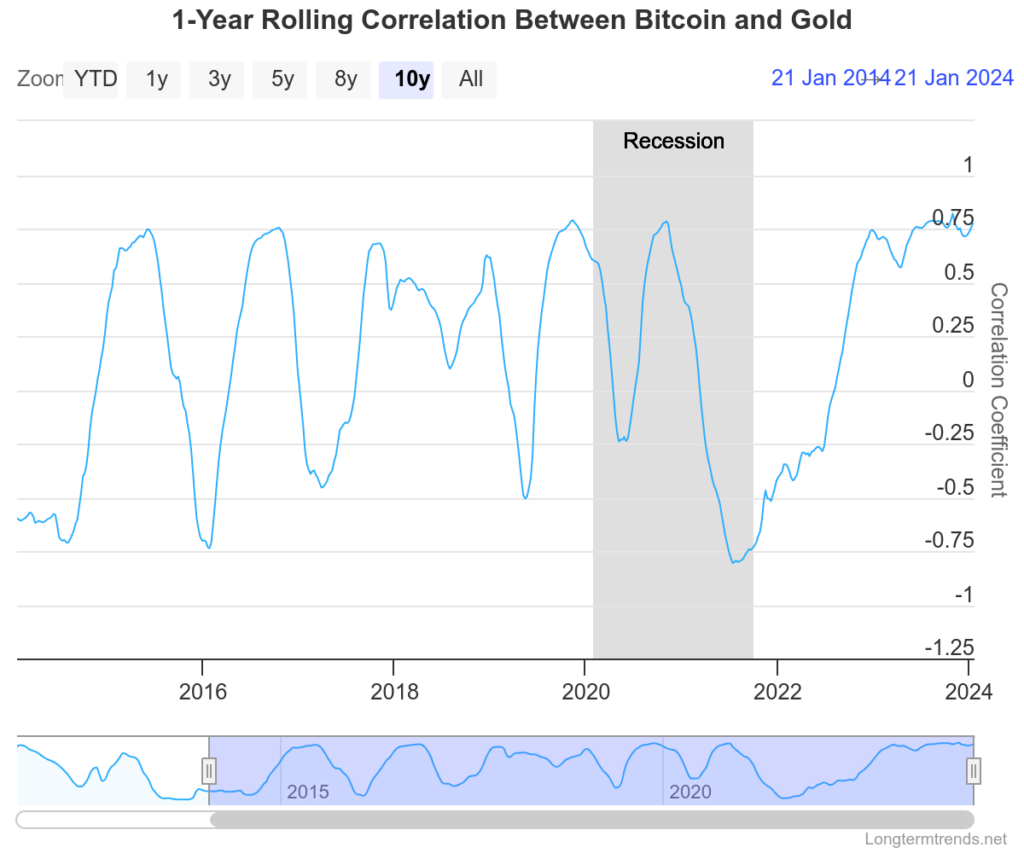

Bitcoin, often referred to as the “digital gold,” has recently shown surprisingly strong ties with this classic asset. The price correlation between Bitcoin and gold, which for most of the digital currency’s history was rather loose, has significantly increased, reaching a level of 76%. It’s noteworthy that a correlation of 1 would mean a perfect reflection of the price movements of both assets, making the current level particularly remarkable.

It’s worth noting that this correlation intensified after the global financial crisis in 2020, triggered by the COVID-19 pandemic. Since then, Bitcoin has increasingly resembled gold in terms of price behavior. This is particularly interesting as Bitcoin has also gained a more “stock market-like” character due to the introduction of ETFs to the market, which allow investing in Bitcoin as one would in stocks.

On the other hand, despite these “stock market” features, Bitcoin seems to be increasingly resembling gold, especially in terms of its role as a store of value. Market analysis shows that in 2023 the value ratio of Bitcoin to gold reached an impressive level, indicating Bitcoin’s strong purchasing power compared to gold.

This phenomenon is particularly interesting in the context of recent economic events, such as high inflation in the USA or the significant increase in Bitcoin’s value in 2023. Investors, seeking not only value growth but also stability in the face of economic uncertainty, may see Bitcoin as an alternative similar to gold. Bitcoin, combining features of both a digital currency and a traditional asset, seems to offer some stability in these unstable times.

It must be emphasized that Bitcoin and gold, despite certain similarities, remain distinct asset classes. Bitcoin, as a digital currency, is characterized by greater volatility and modern features that distinguish it from traditional gold. However, its growing correlation with this classic precious metal indicates an evolving nature of the cryptocurrency market and the possibility that investors are starting to treat Bitcoin as a “safe haven” in turbulent economic times.

Moreover, the introduction of Bitcoin ETFs in the American market was a groundbreaking moment that may have contributed to this change in perception. ETFs, allowing investments in Bitcoin in a manner similar to stocks, have introduced this digital currency into the mainstream financial waters while maintaining its unique characteristics.

The observed correlation between Bitcoin and gold sheds new light on the development of the cryptocurrency market. It suggests that Bitcoin is not only gaining in popularity and accessibility but is also beginning to be seen as a more stable and secure asset, similar to gold. In the face of economic uncertainty and high inflation, both individual and institutional investors may seek in Bitcoin an alternative to traditional forms of investment. Its role as digital gold seems to be increasingly established, which may bring further interesting changes to the financial market.

Photo by Kanchanara on Unsplash